EEMs are part of the brand new FHA’s efforts to improve our very own state’s ecological obligations by the guaranteeing times-effective improvements to your belongings. That this financial support program boasts time-effective air conditioning, furnaces, windows, insulation, solar power panels, etc.

To reach the quantity an individual may obtain, the price of the home is actually put in the expense of the fresh improvements, comparable to exactly how 203(k) do it yourself finance really works. The house Energy Rating Program (HERS) can be used because of the energy specialists to figure out a quotation off exactly how much energy efficiency these types of accessories will bring towards the house.

- The price of the time-saving developments, assessment, and you will accounts, otherwise

- The worth of the home

- 115 % of the average local price to possess an individual-home from the applicant’s area

- 150% of the Freddie Mac computer limit that relates to the house or property

Reverse Mortgages

To include financial help to help you elderly people, the fresh FHA offers reverse mortgage loans to the people that 62 years old and you will a lot more than. This type of financing create individuals to carry out funds against their home equity versus requiring them to pay-off the mortgage, just as enough time as they are located in our house for the question.

The intent is that the https://paydayloanalabama.com/epes/ home loan was reduced from the promoting our home given that occupants are gone, no matter if another person’s heirs may decide to pay off the mortgage out of their very own purse and hold ownership of the house. Tools, possessions taxation, insurance rates, or other will set you back often still need to be distributed from the inhabitant. This unique element associated with the loan system helps it be particularly compatible for all those on fixed revenue, as many old citizens are.

This financing comes in of several versions. It’s also possible to obtain as the a solitary lump sum payment, look for an enthusiastic annuity paying off towards the duration of your occupancy, or install a line of credit to draw with the at your convenience. Because mortgage and you may insurance costs into the property will continue accumulating towards duration of the occupancy, the mortgage could be paid back in the no more than this new residence’s value in case it is vacated.

FHA Family Check Protocols

Brand new overriding purpose of your FHA will be to assists the acquisition out-of safer, safe, and you will sensible housing for People in america. Due to this fact part of their mortgage process is actually undertaking house checks to assess the criteria.

Inspectors check universal problem elements like asbestos insulation, direct paint, soil contamination, leaking roofing, a lot of water (black colored mildew and mold chance), signs of rust, etc. Inside letter cases where such red flags are observed and you will falter is corrected, the fresh FHA supplies the ability to deny loan requests for the told you properties.

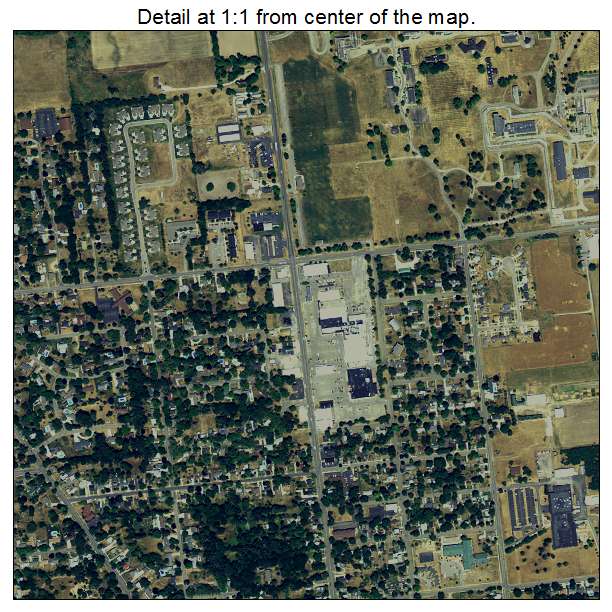

Condition Constraints on the FHA Mortgage Restrictions

![]()

Due to the fact FHA is a federal department supervising the entire nation, individual counties have the flexibility to create its financing constraints according to their variety of circumstances. This type of constraints are often influenced by the home viewpoints inside their elements, which have cities and you can seaside regions getting accorded large financing restrictions. not, for the majority elements of the us, the FHA set an upper maximum regarding $271,050 whenever single-friends land come in matter, although some section push which limitation as much as as much as $625,five-hundred.

Expertise FHA Mortgage Insurance policies

Home loan insurance is necessary to the all FHA financing. Individuals would need to spend an upfront advanced (MIP) if sales are signed, and a yearly premium tacked on to their month-to-month mortgage payments.

Normally, the latest initial MIP is pegged within step 1.75%, since annual advanced rates will vary with respect to the size of down payment in addition to dimensions and you will time of your own home loan wedding.

Forum Nazionale delle Associazioni Familiari – Regione Lazio Senza Famiglia non c'è futuro

Forum Nazionale delle Associazioni Familiari – Regione Lazio Senza Famiglia non c'è futuro